12: House Hunting, USAID, Vanguard's Market Call, America the Laughable, Ukraine Ceasefire, Amazon Dominance, & GOLD

"These guys were literally laughing at America."

You can’t beat Wall Street by reading the Wall Street Journal. Your investing edge is learning things others don’t. Subscribe for FREE to get a unique perspective.

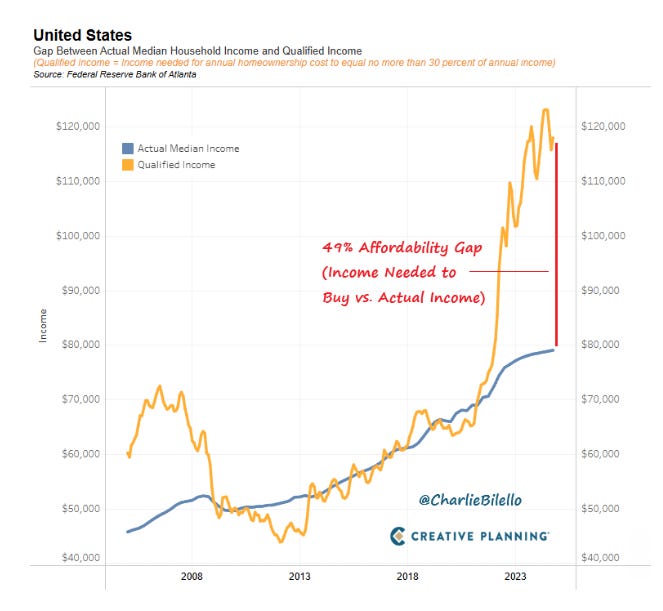

The American dream is to have your own home, a roof over your loved ones' heads, and a place for memories to be made for years to come. But with housing supply at all-time lows and home prices at all-time highs, it seems to be a dream that is drifting away.

Housing has never been more unaffordable.

High mortgage rates and prices are crushing the market. It’s impossible for housing to stay affordable when prices have increased 50% in the last five years — doubling the increase in wages.

I write this for those still in the process. Some have been looking for a long time. Please hang in there. You have worked hard to save up for this moment. You will be rewarded.

I finally purchased my first house. I have been at it for a while. It sucks when you do things right, like pay off your student loans and get your finances in order only to be punished by poorly managed markets.

We did it team.

The Rover:

USAID

What to Know About USAID, the Agency Elon Musk Wants Dead — 2/6/2025

What to Know About USAID, the Agency Elon Musk Wants Dead — WSJ

This is hands down the biggest story of the week, but not much.

It’s been a gut feeling for all of us that the US has been funding groups and policies around the world for a long time. We just didn’t know how. Well…thanks to Elon Musk, now we do.

What is USAID?

USAID provides financial aid to countries around the world—combating human trafficking, battling diseases, feeding people in places with famine and supporting American-allied countries affected by war, such as Ukraine. It also funds equipment, medicine and staffing in countries battling pandemics and disease outbreaks.

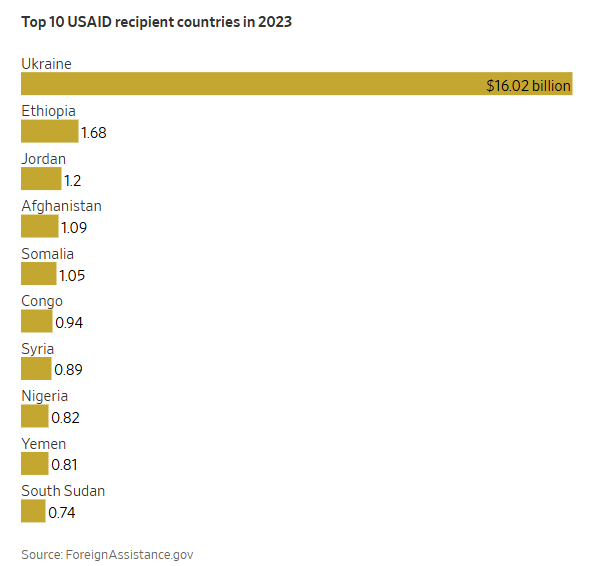

The chart above is in billions of dollars and just for the last year we have the data. And to no surprise the #1 recipient of USAID is Ukraine. Not very comforting as Ukrainian President Zelensky says more than $120 billion out of the total $200 billion sent could be missing. Politicians need to remember tax dollars aren’t free — someone worked for that money.

The idea behind USAID is not the problem. In theory, it’s a positive thing for the world. It saves lives and prevents diseases. Policymakers don’t tell you is it acts as a slush fund to drive narratives. USAID had a budget of $44.4 billion in 2024. Small enough to fly under the radar, but large enough to give out some serious cash.

Inside USAID’s controversial spending: Where your tax dollars went — 1/6/2025

Inside USAID’s controversial spending: Where your tax dollars went — Washington Times

The Trump administration has flagged nearly $200 million in questionable spending by the U.S. Agency for International Development, which Elon Musk and his team have put in their crosshairs for cutting alleged waste and abuse.

Among the most stunning revelations from a White House list of questionable spending was nearly $10 million USAID spent on meals that went to al Qaeda-funded terrorist groups. Then there was the roughly $75 million USAID spent on diversity, equity and inclusion initiatives in foreign countries.

In the name of charity, here is what your hard-earned tax dollars went to:

Vietnam: $16.8 million for “equitable outcomes”

Education: $8.3 million for “equity and inclusion”

Sri Lanka: $7.9 million to combat “binary-gender language”

South Africa: $6.3 million for men’s sexual health study

Global LGBTQ initiatives: $6 million across “priority countries”

Uganda: $5.5 million for LGBTQ causes

Serbia: $1.5 million for workplace inclusion

Iraq: $20 million for local Sesame Street version

News Access: $8 million for Politico Pro subscriptions

Libya: $2.1 million to BBC for “media ecosystem”

Cuba: $1.5 million for media rebuilding

Colombia: $47,000 for transgender opera

Peru: $2 million for transgender comic book

And this is just what has been found in the first few weeks. It will get interesting when DOGE starts to dig into what happened in the Middle East while the US was over there for 20+ years.

And let’s not forget the “Non-Government Organizations” (NGOs) and charities. The Clintons are just one example of powerful people we aren’t really sure how they got rich. But USAID is clearing the air. If these institutions can’t function without federal money, how are they not part of the government?

With such division in the US, it’s frustrating to learn that the “leader of the free world” is funding this division. I am fearful we will find out that USAID funded the BLM riots that tore apart the US. Rumors are also flying of USAID funding liberal media channels, but the media companies have rejected these claims.

In the times of struggling to believe anything you hear, it’s only getting harder.

Vanguard’s U.S. stock-market call

Vanguard’s U.S. stock-market call is even more shocking than you realize — 1/27/2025

Vanguard’s U.S. stock-market call is even more shocking than you realize — MarketWatch

Vanguard — one of the most reputable and respected firms in finance is starting to ask questions such as:

Do we need to own the S&P 500?

Do we even need to own US stock in our retirement portfolios?

The bedrock of nearly every portfolio is changing.

It’s especially remarkable that this should come from Vanguard, the investor-owned index-fund giant. The firm and its legendary founder, the late Jack Bogle, are famous for recommending buy-it-and-forget-it, passive, long-term investments in U.S. stocks.

Vanguard’s “Capital Markets Model Forecast” sees U.S. large-company stocks earning you somewhere between 2.5% and 4.5% a year, on average, for the next decade. That’s before counting the costs of inflation, which Vanguard sees as averaging 1.9% to 2.9% a year. So in “real” or constant dollars — in other words, after deducting inflation — Vanguard’s model sees big U.S. stocks earning you somewhere between 2.6% and minus 0.4% a year.

The above statement would mean that bonds outperform stocks over the next decade.

Investing $10,000 based off Vanguard's forecast would turn $10,000 now into... somewhere between $13,000 and $9600 by 2035. Woof!It’s not rocket science, purchasing anything at all-time highs doesn’t set you up well to make a quality return on it.

Those selling for price-to-earnings ratios of 20 or higher made up just under half of the stocks in the index (240) by number. But they made up nearly three-quarters of the index (73% by value.

To recap, 240 of the 500 stocks in the S&P 500 are selling at a PE of 20 or higher (that means you are paying $20 for $1 of profit), which historically has been expensive. These 240 stocks, like Tesla and Nvidia, have a market value of $40 trillion out of the $65 trillion for the S&P 500, or 73%. The market is expensive.

It’s a good thing you’re subscribed with us because it’s not all doom and gloom. When one asset class gets overly expensive, other asset classes get cheap. Based on the same model predicting terrible returns for the big stocks, we could see international developed markets take off for the first time in a long time — such as Europe, Japan, and Australia. Emerging markets and even the long-awaited rise of US “value” stocks could show good returns.

Nobody knows what the future will hold. As we saw in the .com bubble of 1999-2000, markets just kept going up. Sometimes markets will irrationally continue to go higher while the bears get fired. It’s not fair, but that is life.

America, the Brave — or America, the Laughing Stock?

laugh·ing·stock

/ˈlafiNG ˌstäk/

noun

noun: laughing stock

a person or thing subjected to general mockery or ridicule.“First we let China hollow out our industrial base, then the engineering expertise followed, and now we can’t even make the best AI hype anymore.” — 1/31/2025

Oren Cass, the Chief Economist at American Compass (a policy thinktank) offered a hot (but accurate) take on last week’s DeepSeek news:

A few quotes on the US getting its ass kicked by China:

“If you even whisper the phrase ‘industrial policy’ in Washington DC today, within 24 hours you will be stoned to death. I mean, China is out there eating [our] lunch every day but we still won’t challenge the orthodoxy…I read all these Washington economists’ reports and think tank studies that say ‘Let the market work’, except that the guys who are writing the books in China think it’s f***ing bullsh*t. [They say] ‘Please let those guys in Washington keep reading those books. Things are going just fine!’” -GE CEO Jeffrey Immelt, 2011

“A few months earlier, Brad Avakian had been on an official visit to Taiwan. One evening his hosts took him out for a drink. As they began to unwind, the conversation turned to America. ‘These guys were literally laughing at America. They couldn’t understand the game we were playing. They said “Please keep sending us all the jobs, everything else will follow.”’

-Brad Avakian, Oregon’s Labor Commissioner, 2011, as quoted in “Time to Start Thinking.”

In China, she said, people tend to think in the long term. Americans seemingly cannot see beyond the next electoral cycle. “When I was a child [growing up in China], they had a slogan: ‘Overtake the UK and catch up with the US. China is halfway there and the goal hasn’t changed.” “He talks to me about all the support government is putting into science and education in China. When I compare what is happening in China to the budget cuts we’re getting in California, I feel really tempted to go back to teach in China.”

-Ching-Hua Wang, Head of the Biotechnology Department at California State University in Camarillo, 2011

Some of these warnings are from over 10 years ago. Are the forward thinkers 15 years ahead of policymakers? Frightening…

No one ever expected it to be easy being “leader of the free world,” but this is embarrassing. China is playing the game better, and we are letting them win.

Maybe it has taken us so long to realize this, as this would cause policymakers to admit the same errors over decades, not just years. In the grief stage, acceptance is the final step. We may finally be at the acceptance stage, but regardless — something has to change.

The Truth Behind the Ukraine War Ceasefire

Amid talk of a ceasefire, Ukraine’s front line is crumbling – 1/27/25

Amid talk of a ceasefire, Ukraine’s front line is crumbling — Economist

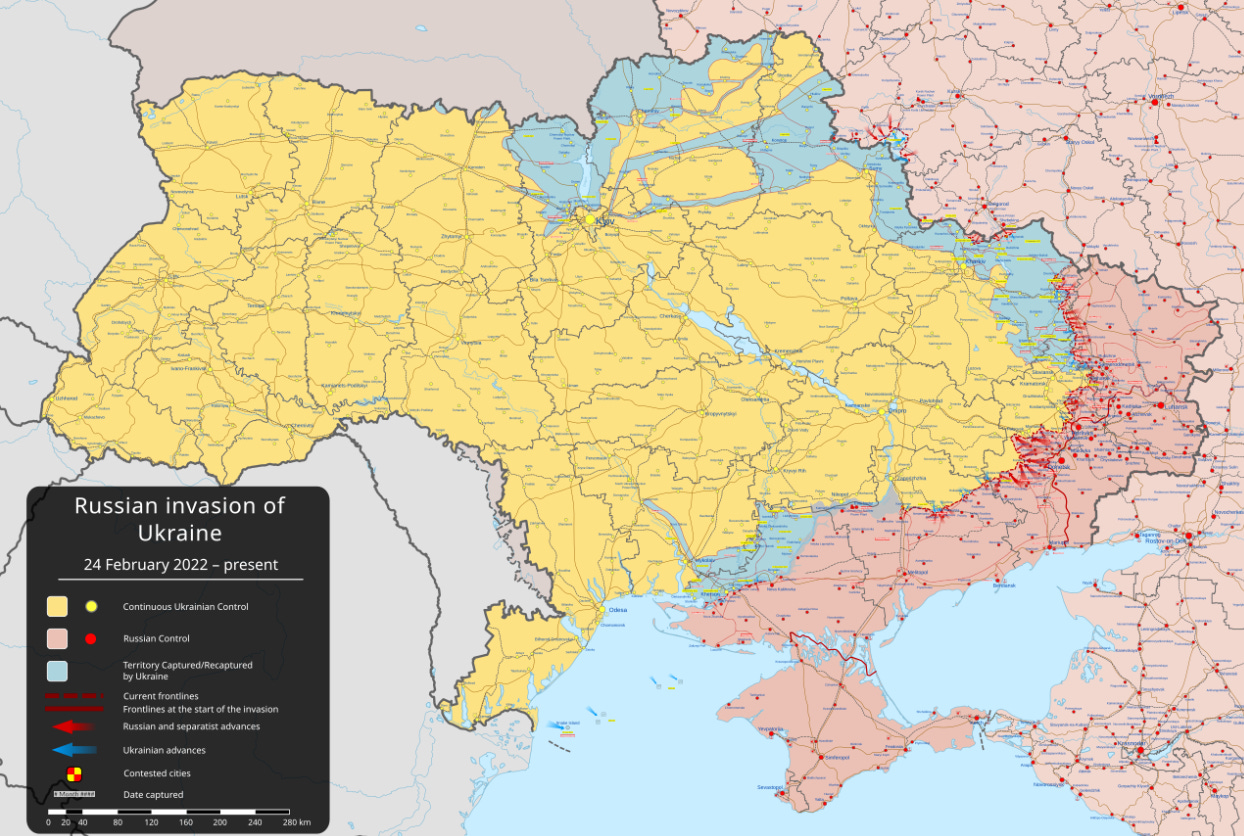

Anglo-American coverage of the Russia/Ukraine War thought Russia’s strategy would follow the US and UK in Iraq of “take as much land as possible”, and therefore, Russia’s lack of geographical progress for much of 2023 and 2024 was proof of Ukraine winning with NATO’s help, but this was based on a tragic misapprehension.

The Russian strategy (after the initial error), appears to have been essentially (and brutally) to create kill zones, and then kill Ukrainian soldiers and NATO weapons that entered the zones, until the Ukrainians ran out of men, NATO ran out of industrial capacity to make more, and the western public lost patience and moved on to another news story…and sadly, the story above suggests the Russia strategy has worked.

With the war expected to end soon, that is a win for the world. For the cease-fire to be solidified, Ukraine is giving up land and not joining NATO. This is exactly what Putin wanted.

$200 billion (over $120 billion “lost” or never received mentioned above) to Ukraine from the US and NATO to lose. This reminds me of the question I always ask myself — are wars worth it? Instead of giving Putin what he asked for right away, we spent $200 billion and lost millions of lives.

The Lessons Learned:

Russia proved that the US and NATO cannot defeat Russia or China in their backyard without taking casualties which would likely make all other wars in US history look like a street fight by comparison.

The post-1971 dollar reserve status structure was proven to have undermined the US defense industrial base so severely that the US could not use its military against a peer or near-peer power to defend that same dollar reserve currency status.

China knows that making CNY the global reserve currency to replace the USD as structured since 1971 would do the same to China. It has advocated replacing USTs with gold that floats in all currencies since 2009.

The US military-backed NATO just lost in Ukraine to a nation with 1/10 its GDP in USD terms. Monetary systemic change is the only way the US gets out of this situation — look at the price of gold.

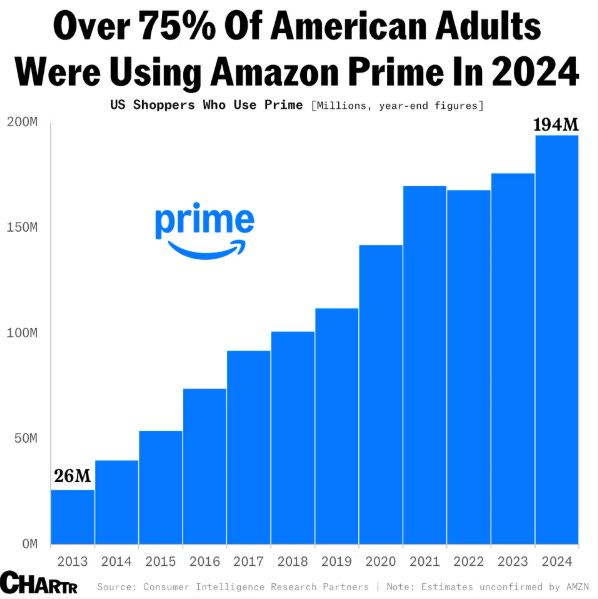

Over 75% of American Adults use Amazon Prime

Amazon delivered 9 billion items on the same or next day in 2024 — 2/5/25

Amazon delivered 9 billion items on the same or next day in 2024

This is insane. Can you think of anything else that 3 of every 4 people you know use?

Ahead of its Q4 earnings on Thursday, Amazon has already been delivering some blockbuster figures this week, revealing on Tuesday that it shipped a staggering 9 billion items the same or next day last year.

Bezos’ big box giant also announced that Prime members around the world saved almost $95 billion on free delivery last year, while US subscribers saved $500 on average — almost 4x the annual price of Prime, the retailer was keen to point out.

Amazon is an amazing business that just continues to grow. Just think, if you can create a business that 75% of people use, you too could buy the largest sailing yacht on the planet.